Tax Deduction Pro-Tips for Rental Real Estate Owners

Appfolio Websites • March 30, 2020

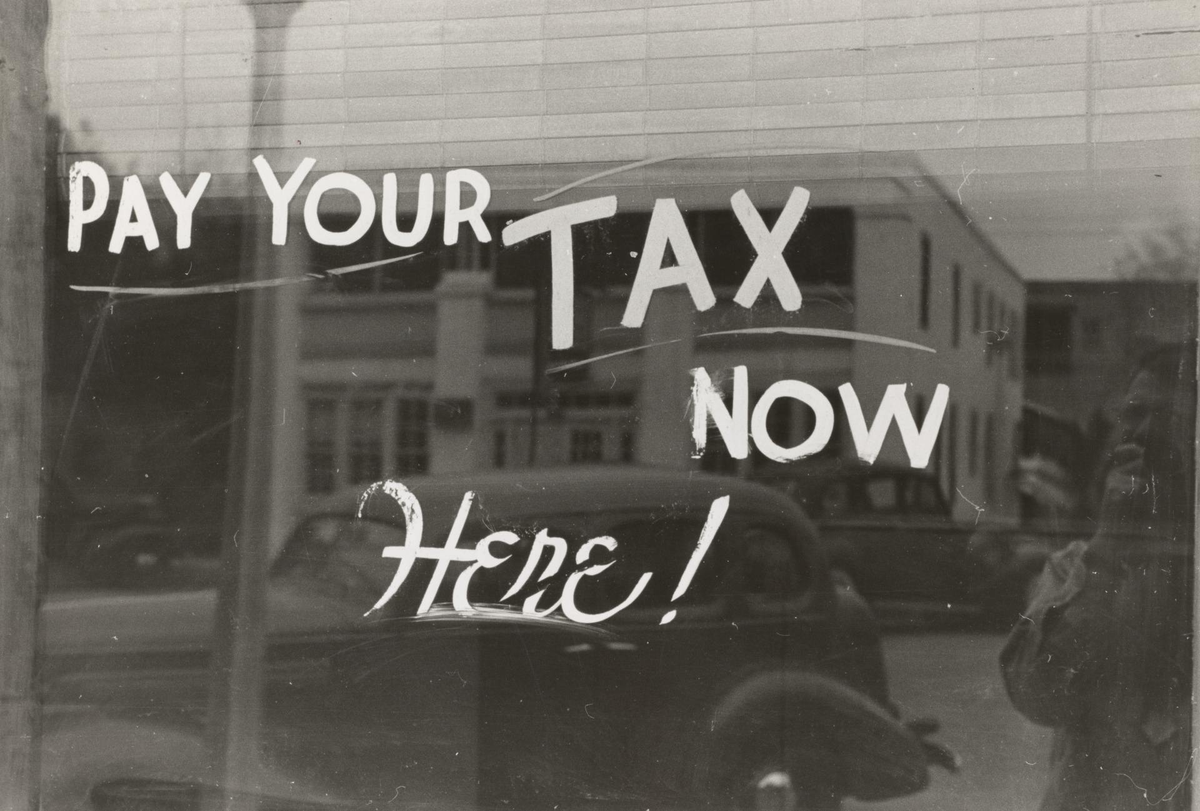

Your tax deadline has been extended. Let's make the most of it.

Amid the COVID-19 crisis, you now have three more months to complete your taxes.

What was once an April 15 deadline is now officially July 15, 2020.

So, what are you going to do with that extra time? Hopefully, amid all of the craziness happening in our world at the moment, this allows you a few extra minutes or so to truly maximize your returns.

For rental real estate owners, there are a few specific things to keep an eye on this year.

And, before we dive into those items and very importantly: Please turn to your tax advisor and/or the governing bodies that exist (e.g. the IRS) for the latest recommendations and/or items that may apply to you. The below is a shortlist of generally public information.

On that note, here are the tax deductions that rental owners should be looking at this year:

1) Materials and repairs.

Think of the repairs – and what was needed for them – that took place at your property in the prior year. This can range from a leaky refrigerator to an unsealed window to some major drywall repair. These repairs are totally tax deductible.

2) Home improvements.

No, we’re not talking about the Tim Allen sitcom here. And, no, you cannot straight up deduct the cost of improvements, like enhancements to a home’s structure or key systems, including electrical, HVAC, fire protection, alarm and security. But, you can recover some of your improvements by claiming depreciation, which is outlined in detail by the IRS.

3) Mortgage interest.

Landlords can deduct interest paid on a mortgage for a rental property. A couple of tips on this front: Your claim must be below the property’s principal limit and the claim must be made on Schedule E, as part of the property’s expenses.

To kick your property management efforts into high-gear, give Arlington Realty Property Management a buzz today at 703-836-2525 or email mypropertymgr@gmail.com.